SHOWTIME’s new series Billions kicks off introducing us to hedge-fund titan Bobby “Axe” Axelrod and the head of Axe Capital who faces-off against his nemesis, U.S. Attorney Chuck Rhoades. While the show definitely has a flare for the dramatic, some of the scenarios depicted are an accurate reflection of the current securities industry. In this blog series, we will explore the legal regulatory issues as they appear in the show and address how relevant they may be to you and your firm.

Read MoreJacko Law Group Blog

Today, IAWatch revisited the case of Thomas Haider, a former CCO at MoneyGram, who was assessed a $1 million civil money penalty by FinCEN. In 2012 MoneyGram paid a $100 million dollar fine for fraud against its customers. In 2014, “FinCEN assessed a $1 million civil monetary penalty against Haider based on his alleged willful failure to ensure that MoneyGram (1) implemented and maintained an effective AML, and (2) filed timely SARs.” This was the first time the government has tried to hold a Chief Compliance Officer personally responsible for their employer’s failings. Haider’s attorneys tried to have the case dismissed but the judge threw aside the arguments and the case is going to trial.

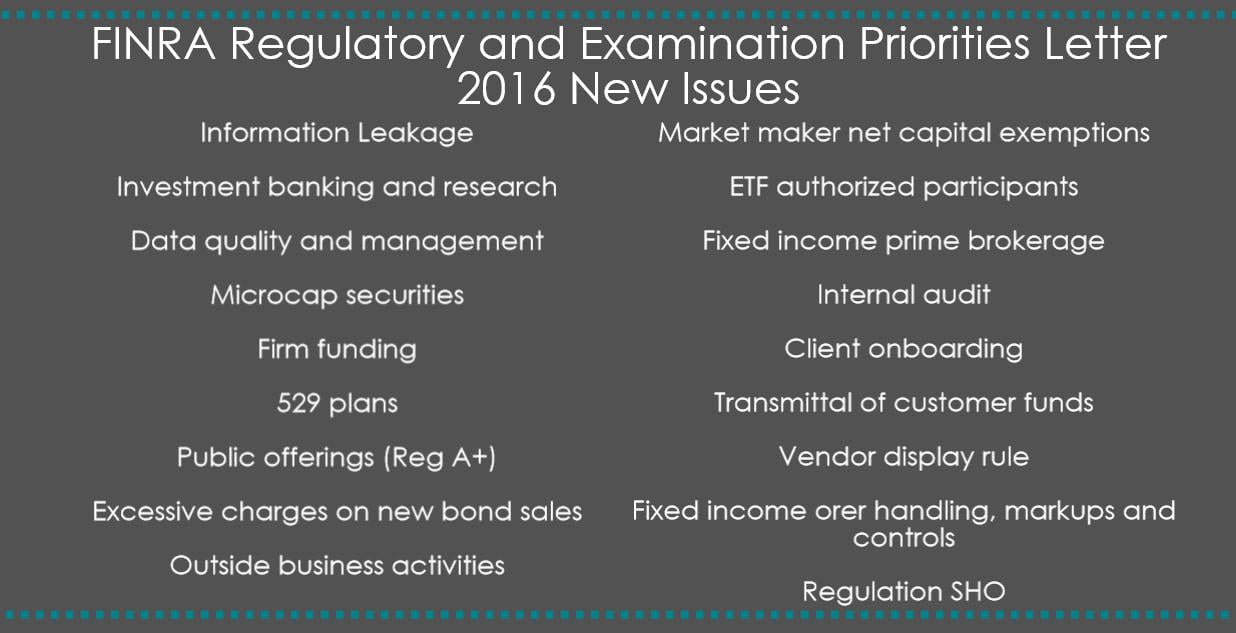

Read MoreOn January 5, 2016, FINRA published their 2016 Regulatory and Examination Priorities Letter (the “Letter”). Many of priorities discussed had appeared on previous examination priority letters. However, there were several notable new additions to this year’s Letter that warrant additional consideration. Below is a brief synopsis of some of the new issues specifically addressed by FINRA for 2016:

Read MoreIn its latest press release, the SEC announced that J.P. Morgan’s (JPMS) brokerage business agreed to pay $4 million to settle the claim that they made false statements in their marketing materials and on their website. The incorrect materials were being used from 2009 to 2012. While they were identified by internal staff as being false on at least four occasions from 2009 to 2011, J.P. Morgan did not proactively correct the materials until 2012.

Read MoreLegal Tip Archive

- September 2011 (5)

- April 2014 (5)

- August 2014 (5)

- September 2015 (5)

- August 2011 (4)

- October 2011 (4)

- June 2012 (4)

- July 2012 (4)

- August 2012 (4)

- October 2012 (4)

- November 2012 (4)

- January 2013 (4)

- March 2013 (4)

- April 2013 (4)

- May 2013 (4)

- June 2013 (4)

- September 2013 (4)

- October 2013 (4)

- January 2014 (4)

- February 2014 (4)

- March 2014 (4)

- May 2014 (4)

- June 2014 (4)

- July 2014 (4)

- December 2014 (4)

- January 2016 (4)

- November 2011 (3)

- December 2011 (3)

- January 2012 (3)

- February 2012 (3)

- April 2012 (3)

- May 2012 (3)

- September 2012 (3)

- December 2012 (3)

- July 2013 (3)

- August 2013 (3)

- November 2013 (3)

- December 2013 (3)

- January 2015 (3)

- February 2015 (3)

- March 2015 (3)

- July 2015 (3)

- August 2015 (3)

- November 2015 (3)

- February 2016 (3)

- March 2012 (2)

- February 2013 (2)

- October 2014 (2)

- November 2014 (2)

- April 2015 (2)

- May 2015 (2)

- June 2015 (2)

- October 2015 (2)

- December 2015 (2)

- July 2011 (1)

- September 2014 (1)